No more branch visits! Open your investment account at your convenience. Our digital platform is designed to provide you with a hassle-free account opening experience.

Click Here to Open Your Account

Key Features & Benefits

Eligibility and Required Documents/Details

Any Pakistani individual with a valid identity document (CNIC/SNIC/NICOP/SNICOP/POC), Email ID & Mobile Number can open ABL Funds Digital Account.

Yes, any overseas Pakistani National with a valid identification document can open an online account subject to a valid PKR bank account, email ID, and mobile number.

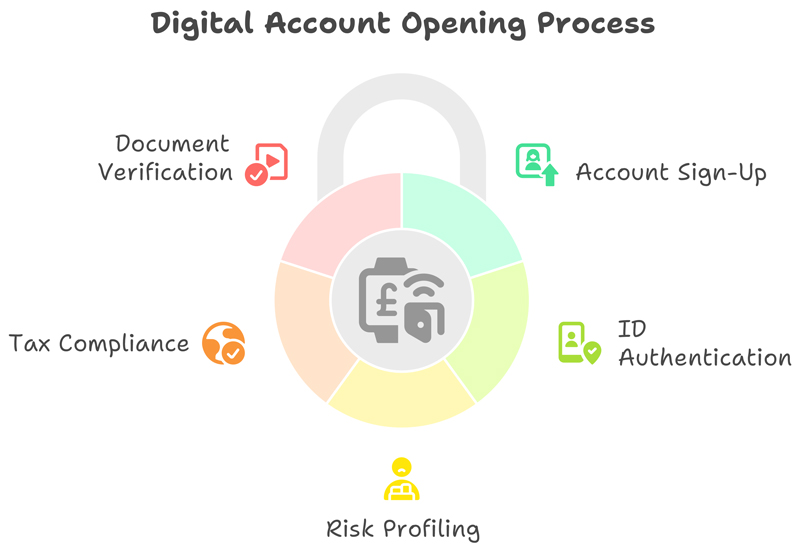

Follow these steps: 1. Account Registration, 2. Account KYC, 3. Risk Profiling, 4. FATCA & CRS, 5. Document upload & video verification.

If all documents are ready, the process should take around 10 minutes (T&C apply).

Identification document, income proof, next of kin ID (if applicable), zakat exemption certificate (optional), signature card, and any mobile ownership proof.

No, existing investors must use the web or mobile app to manage accounts.

ABL Funds will contact you after internal checks. Any discrepancies will be communicated.

Yes, based on your Risk Profiling responses during registration.

You can apply anytime. Processing depends on business hours/cut-off timings.

It includes predefined information customers must read and accept during onboarding.

You can start with PKR 1,000 or PKR 5,000 depending on the product.

No, there's no minimum balance requirement.

Yes, unless you submit a Zakat Exemption Certificate (C-Z50).

NAV is applied after fund transfer confirmation within cut-off times.

Yes. We maintain strong encryption, firewalls, and access controls.

Yes, you must meet the eligibility requirements.

No, a valid ID is mandatory.

You can use a family/employer number with proper authorization.

Contact us at 042-111-225-262 or email contactus@ablfunds.com.

You may resend the OTP 3 times daily. If it still doesn’t work, call the helpline.

Use the "Forget Password" option on the login screen.

Yes, after account opening, log in to MyABL portal and initiate transactions.